Special Report Smart Ship Development Status and Tasks(2)

페이지 정보

작성자 최고관리자 댓글 0건 조회 3,475회 작성일 19-08-21 12:10본문

III. Status and Tasks for Smart Ship Development in Korea

1. Domestic Smart Ship Development Status

Domestic Smart Ship development is dominated by three major shipbuilders. Unlike other industry-leading nations, Korean shipbuilders develop their own ships through independent R&D. Despite much debate on the pros and cons of individualized development, each company has successfully responded to the market based on its own strategy.

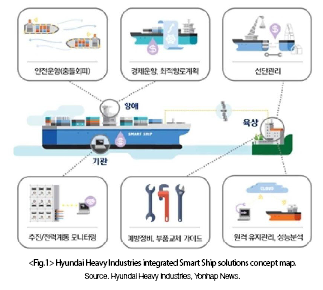

(1) Hyundai Heavy Industries

Hyundai Heavy Industries, the world’s leading shipbuilder, is developing a step-by-step Smart Ship system. In 2012, the company developed Smart Ship 1.0 with a remote monitoring function, which has been, to date, installed in over 300 of its vessels. Currently, the company is developing Smart Ship 2.0 focusing on eco-friendliness, smart operations and fuel efficiency. Development for Smart Ship 3.0 is planned as the ‘next-generation solution’. In July 2017, the company announced that it had developed the first integrated Smart Ship solution which improves safety and efficiency by analysing voyage information in real-time. It was reported that the integrated Smart Solution maximized energy efficiency by optimally controlling the engine and propeller through energy data analysis. Furthermore, operational efficiency was maximized through hull positioning and navigation speed information analysis, which minimized resistance leading to a 6% reduction in operating costs.

In addition, collision avoidance and other safety-related, device monitoring and remote maintenance solutions relevant to the ship’s operation were also integrated.

Hyundai Heavy Industries’ Smart Ship development was accomplished through its own development capabilities as well as extensive cooperation with domestic and overseas institutions. In 2008, the company, in cooperation with the Electronics and Telecommunications Research Institute(ETRI) and Ulsan University, began Smart Ship development equipped with a navigation information recording device and propulsion control device. In 2011, they were able to launch the first ship with an all-in-one data network. In 2012, the company began developing Smart Ship 2.0 with the Ministry of Industry and Trade and several IT-related SMEs. In August 2015, together with the global consulting firm, Accenture, jointly developed a ‘Connected Smart Ship’ which integrates ship navigation, logistics and port information.

In 2017, Hyundai Heavy Industries signed an MOU with Saudi Arabia’s largest state-owned shipping company, Bahri, to cooperate with Smart Ship development. In March 2018, the company signed an MOU with a renowned engine developer, Swiss WinGD, to upgrade engine diagnostic capabilities in order to enhance remote monitoring and ship engine servicing.

In October 2018, Hyundai Heavy Industries signed an MOU with Intellian Technologies, a satellite antenna systems provider, and Inmarsat, a satellite communication service provider, to develop Smart Ship satellite communication service technology, and establish a testbed for reliability verification. In developing Smart Ships, Hyundai Heavy Industries is expected to strengthen its future business capabilities by having an inter-company cooperative system with its various subsidiaries.

Hyundai Heavy Industries is expected to lead Smart Ship development, and also play a key role in future Smart Ship construction. Hyundai Electric, an affiliate responsible for electronics and solutions, has developed INTEGRIC, and integrated ICT platform for connecting in-vessel devices. Hyundai Electric is expected to provide future support services. It is presumed that Hyundai Global Services operations will enhance Smart Ship monitoring, diagnosis and maintenance following Smart Ship delivery. Overall, it is expected that Hyundai Heavy Industries’ Smart Ship development will be carried out in a systematic manner with its own strategies and structures. However, it is regrettable that the company lacks wide-ranging cooperation with maritime organizations.

The company seems to be spurring Smart Ship development with its systematic structure and inter-group, long-term strategic approach. However, inefficiencies may arise from its independently developed platform which is unlikely to be adopted as an international standard. Due to the company’s lack of cooperation with the Heavy Equipment Industry, there is a high risk of competition from Kongsberg’s position at the centre of the European Heavy Equipment Industry.

(2) Samsung Heavy Industry

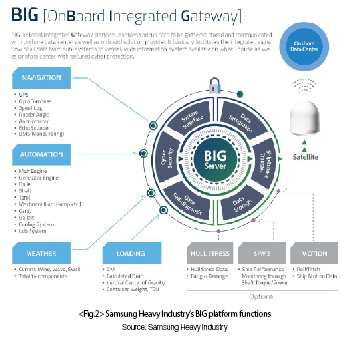

Samsung Heavy Industry has developed its own smart vessel solution ‘Intelliman Ship’ and has begun installing it on all contracted vessels commencing January 2018. The company’s solution has the capability of collecting and analysing 1,000 pieces of data including the vessel’s location and equipment status in real-time. The solution is based on ‘On-board Integrated Gateway’ (BIG), a platform for onboard data acquisition, storage and communication.

The vessel’s onboard solution provides the captain with analytical values to support decision making such as shipping routes and navigation optimization, fuel efficiency monitoring, and motion monitoring. The acquired data can be downloaded and used from onboard the vessel. All data is downloadable from Amazon Web Service’s Cloud. Shipping companies can analyse data on its fleet using ‘s.fleet’, software provided by Samsung.

Samsung Heavy Industry’s solution is equipped with eco-friendly and highly efficient functions, which have lead it to obtain technical certifications in adherence to European and IMO regulations. Samsung Heavy Industry has also developed the Energy Saving Device(ESD) to increase fuel efficiency and relay accumulated, real-time data from fuel consumption and CO2 emissions. The quality of navigation reports produced from ESD’s data has lead to accreditation from the American Bureau of Shipping (ABS) which illustrates the devices technological reliability. As a result, have successfully been able to submit reports as required in Europe or by the IMO.

Samsung Heavy Industry has currently achieved and commercialized remote Smart Ship monitoring and is expected to carry out R&D for Smart Ship remote controlling. Following commercialization of equipment remote monitoring, the company has also managed to solve the issue of big data collection. Big data collection is made possible during Samsung vessels’ one-year service period. And according to servicing conditions, long-term big data collection is expected to become possible in the future. Big data will become an important asset for future Smart Ship development. The company is developing its vessels step-by-step and has, to date, achieved remote monitoring. It is expected that future development will focus on remote controlling, and inevitably autonomous navigation technology. However, due to individualized solution developments, the market lacks standardization. As a result, it is difficult to identify the market’s direction nor any definitive leaders.

(3) Daewoo Shipbuilding and Marine Engineering(DSME)

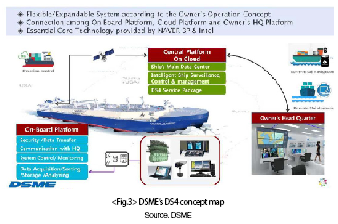

DSME is also developing its own platform and solutions. In October 2016, DSME opened the ‘Hardware in the Loop System’ (HILS) centre for marine control systems research to conduct R&D for its automation and control systems. In May 2018, DSME signed a tri-party agreement with NAVER and Intel to jointly cooperate in Smart Ship development. An agreement with NAVER’s Business Platform (BP) allowed for DSME to utilize Smart Ship data through the integration of BP’s cloud services into its infrastructure. Intel’s IoT systems will be adopted for DSME’s onboard solutions.

DSME is developing its own Smart Ship model, the DS4. Cooperation with NAVER BP and Intel is a part of its development.

DSME’s developments seem to have achieved a sufficient level which can be applied to vessels; however, no results can be found. Furthermore, there is a lack of information to highlight cooperation with ship owners to secure big data. DS4 developments are estimated to be at a contract-applicable stage, but actual contract results are unknown. There is also no record of deliveries. Actual cases of securing big data are not yet clear and also unknown.

(4) Other

Until now, aside from the three companies identified above, there is no known large-scale project by companies or academia. It is assumed that any relevant research is limited to equipment development. Overseas cases of state-led, large-scale projects involving industry and/or academia is unknown. However, it is presumed that equipment research is carried out at national research institutes.

2. Domestic Smart Ship Development Implications and Tasks

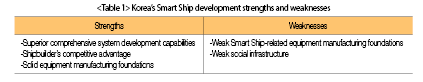

(1) In the development of Smart Ships, Korea is a shipbuilding powerhouse; however, its competitiveness in equipment manufacturing is low compared to Europe and Japan.

Korea’s strength in leading Smart Ship development is based on the fact that it is home to the world’s best shipbuilders and is best able to develop a comprehensive ship system. The equipment industry, including engines, is capable of comprehensive support.

Weaknesses are that the competitiveness and reliability of equipment, which is crucial to Smart Ship, such as navigation, communication and ship control, are lower than those manufactured in Japan or Europe. Europe’s competitive advantage is the basis for the region’s strategy to lead the Smart Ship market. Japan is also planning to expand its market share in the shipbuilding market.

Another weakness is Korea’s social infrastructure from its lack of maritime laws and systems than those of other developed nations. This weakness can be a factor for Europe to lead the market by establishing Smart Ship-related regulations in line with the West.

(2) Domestic Smart Ship development led by three dominant companies have performed exceptionally but has also given rise to problems.

Smart Ships require more capabilities and technologies such as equipment, communication technology, big data analysis, measurement and control as well as regulations than conventional ships. Each of the three companies has strong cooperation with other organizations in order to secure these competencies. However, they lack a strong capacity for cooperation with the equipment industry. This will be a difficult obstacle for the three companies to overcome.

(3) State support for Smart Ship development has been announced, but yet to be implemented.

In 2017, Korea Research Institute of Ships & Ocean Engineering(KRISCO), the Ministry of Industry and the Ministry of Maritime Affairs and Fisheries along with national research institutes, universities, the equipment industry and domestic shipping companies participated in the preliminary Smart Ship feasibility study. However, the project was closed in 2018 from a lack of concrete planning. This resulted in an end to the possibility of support for state-sponsored development. The project’s closure lead to inefficient use of time but has contributed to the beginning of a new feasibility study. However, as the project will take another two years for planning and review, Korea will fall behind its competition.

Unlike Europe, Japan, China, and other competitors who are developing alongside state support and cooperation with various institutions, the Korean government is neither willing nor is it able to identify development methods. As a result, Korea’s three Smart Ship developers are at a disadvantage from the lack of state support, unlike their competitors. In addition, there are no countermeasures in the domestic small equipment industry and the medium shipbuilding industry, both of which are dependent on state support. There is growing concern that the competitiveness of Korea’s Smart Ship development will decline significantly compared to its competitors.

(4) Concerns arise from failure to acquire state-led competitiveness from lack of cooperation between agencies

Cooperation between the shipbuilding industry, equipment industry, shipping industry and related-national agencies is ineffective. Individual companies, as a result, will have to cope with market changes at an individual capacity. For example, Hyundai Heavy Industry and Samsung Heavy Industry have only been able to attain monitoring big data from their customers. However, limitations have prevented them from attaining remote control big data necessary for automated operations which have caused them to lag behind their overseas competitors. In order to develop remote control and automated operations, it is necessary to establish development arising from national support and cooperation with shipping companies to construct and test ships in ports. However, as development is limited to Korea’s three companies, cooperation must occur on an international level. If Korea’s development were to fall behind their competitors, then they would be at a disadvantage in that their competitors, either Japan or Europe, would set new international standards.

After Hanjin Shipping, Korea’s sole ship research and developer exited the market, it has become difficult to rely on domestic shipping companies for R&D. Following the launch of Smart Ships, the market has begun to change. As a result, it is important to consider the hindered adjustment of domestic shipping companies to the changing market. The domestic equipment industry is also expected to be unable to adapt. There is a high possibility that the market will be taken over by Kongsberg-led European equipment industry. As the competitiveness of all maritime-related industries, except for Korea’s three major shipbuilders, will inevitably be degraded. Cooperative measures are urgently needed.

(5) Issues surrounding development efforts of Korea’s three shipbuilders

The three domestic shipbuilders were discussing the unification of Korea’s platform to take a joint market-leading position. However, discussions were suspended in 2016 due to a lack of compromise. Since then, each company has developed its own platform and system which focuses on their own ship’s efficiency. Kongsberg’s advanced platform and equipment technologies are highly regarded by European ship owners. It is likely that shipowners will select Kongsberg’s systems when ordering vessels. In this case, it is necessary to negotiate the mutual scope and burden of work towards resolving ship and equipment system problems. If Korea’s three companies were to respond individually, their negotiation power would decline, adversely affecting their competitiveness.

If the three companies unify towards the same platform and successfully provide it to the European equipment industry, then the equipment industry can use it in system development according to the world’s top three shipbuilders and reduce unnecessary efforts and costs. In addition, the system developed through the cooperation of the equipment and shipbuilding industry can enhance trust amongst European ship owners and be used as a competitive advantage over competitor nations. At present, Japan is prepared to develop a nationally unified platform. However, its shipbuilding industry is weak. If Korea were to prepare in time, it may be able to prevent Japan’s accession to a market-dominating position. Unification of Korea’s three shipbuilders will also be advantageous to the domestic equipment industry, which can serve as a basis for the domestic industry to compete with the European equipment industry.

(6) National Support and International Cooperation Should Be Initiated

In order to eliminate the problems surrounding the risks and concerns of Smart Ship development, national support is required as soon as possible and development should proceed through international cooperation. Therefore, the three shipbuilders should resume discussions on platform unification and work towards opening-up strategies.

In addition, the government should further its legislative support for Smart Ship development with national funding as soon as possible. Industry and related maritime agencies should also prepare to research and address the challenges surrounding Smart Ship development, as well as prepare to participate in national-level discussions. New means of research-level cooperation between the IT industry, than the shipbuilding industry, is required.

IV. Conclusion and implications

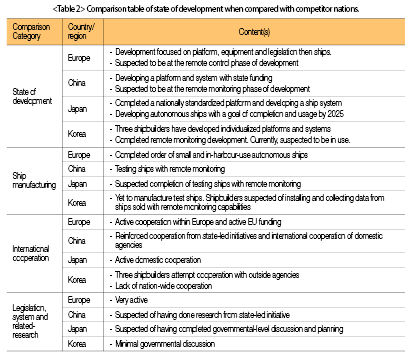

Table 2 illustrates Korea’s current state of Smart Ship development when compared with competitor nations. Lacking areas require immediate action.

(1) The Smart Ship market is riddled with uncertainty, thus much preparation is required.

With rising Smart Ship construction costs from the increased installation of sensors, communication and other equipment, there is still much uncertainty whether costs saved on manpower and fuel can cover increased CAPEX investments. In addition, unlike the autonomous vehicle market, where global IT companies such as Google are active participants, the number of participating companies in the Smart Ship market is less than that of the autonomous vehicle market.

However, this situation should not be accepted as time-wise, and it should be recognized that ship automation is an occurrence arising from port automation. In addition to domestic shipbuilding and maritime industries, maritime-related systems and changes in business models require steady preparation to keep pace with competitors’ developments.

(2) Continued study of Smart Ship market trends in addition to technological development

Continued study and research of strategy to cope with developments. As mentioned above, arising from Kongsberg’s proprietary platform development and equipment portfolio construction and Japan and China’s development of a national platform, there is a high degree of uncertainty in the market.

There is a possibility that future market composition will change depending on which country or company’s platform is opened up to and with whom. In addition, as no country nor company has any clear strategy, it is believed that all respective parties are deeply contemplating their future strategies. Under current circumstances, it is important to accurately understand development and market trends whilst developing a business strategy. Depending on the strategy, it can be decided whether the domestic industry will take a market-leading position or fall into a market-dependent position. Strategic selection and the direction of future platform development, the direction of future applied equipment partnerships, technological advancement, environmentally-friendly ships and reduced operating costs are expected to be important factors in strategic research. Therefore, it is important for the industry to expedite technological development as well as increasing efforts to study market strategies.

(3) Transnational efforts are very important and necessary

Current changes are global in scale. The shipbuilding and marine markets make up a single global market and cooperation with transborder organizations is also important. However, cooperation and mutual development among domestic institutions are important for the survival and development of the domestic shipbuilding and equipment industry through new opportunities in response to global changes.

The shipbuilding industry’s Smart Ship development will require cooperative efforts with the domestic equipment industry in so that the shipbuilding industry is firmly supported to maintain superior cost competitiveness. The shipping industry also needs to establish a long-term competitive strategy through cooperation with the domestic shipbuilding industry. The shipbuilding and equipment industry should also attempt at leveraging the capabilities of relevant domestic industries, such as the IT industry, through cooperation. In addition to technological development, institutional and legal changes are also expected. Cooperation with related organizations and government is required. In order to lead cooperation among domestic institutions, the government needs to play a more active role not only supporting development costs but also coordinating the interests of institutions and supporting their research.