Feature Story Trend of Danish Market for Marine Equipment in 2018

페이지 정보

작성자 최고관리자 댓글 0건 조회 3,331회 작성일 19-05-24 21:45본문

1. Market Size & Market Trend

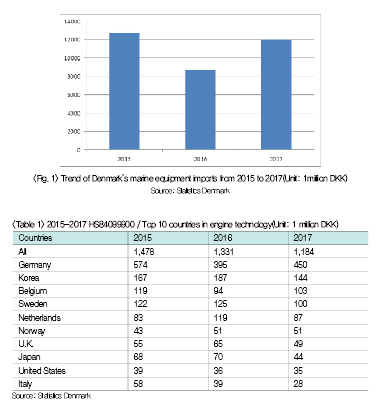

(1) Trend of Denmark’s imports of marine equipment

Denmark imported 12,686 million DKK in 2015, 8,658 million DKK in 2016, and 12,017 million DKK in 2017 based on the items such as engines, ballast water treatment system, tank carrier, ships(passenger ships/freight vessels).

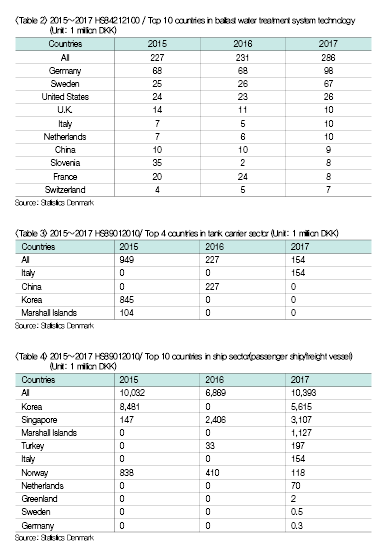

(2) Top 10 countries for Denmark’s imports by HS code

Top 10 countries for Denmark’s imports by HS code are presented in Table 1 through Tale 4.

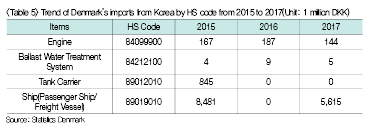

(3) Trend of Denmark’s imports from Korea by HS code

Trend of Denmark’s imports from Korea by HS code is presented in Table 5.

(4) Denmark evolving into the world’s leading shipping industry hub

According to IHS/SEAWEB, Denmark’s national flag-carrying commercial vessel segment has expanded steadily over the years with robust growth in 2018. Demark is home to many of world’s leading shipping companies including Maersk, Torm and DFDS. Denmark’s national flag-carrying commercial vessel segment expanded by 25% in terms of scale between April 2017 and April 2018, which shows the growth by 3.8 million GT in just one year. Containerships comprised the largest proportion in gross tonnage, while coastal vessels and special purpose vessels accounted for the largest proportion in terms of the number of vessels.

(5) Number of Denmark’s national flag-carrying vessels & strong demand for related vessels and marine equipment

Denmark was ranked 10th worldwide in terms of number of national flag-carrying vessels and shipbuilding orders, as of October 2018. Shipbuilding orders plunged in 2016 due to stagnation in shipping industry. However, a rebound and growth of shipbuilding orders are anticipated amid gradual turnaround in the shipping market. As shipbuilding orders increase, the demand for marine equipment is likely to rise.

2. Key Issues and Trend

(1) Rising demand for eco-friendly equipment

Denmark is traditionally an environmental leader worldwide and has established a leading position in eco-friendly technologies in the fields of energy, transportation, air and water quality management and food. In the sector, Denmark has actively introduced eco-friendly technologies in shipbuilding and offshore sector, presented a proposal to the International Maritime Organization(IMO) for carbon dioxide emission reduction, along with a proposal for support of developing countries based on adoption of fuel dues, and introduced the Design Index’ for more rigorous requirements for carbon dioxide emission control in newbuilding construction. The Danish Shipowners Association has already set a target of reducing carbon dioxide emissions by 25% by 2020 in 2008, and the target is considered to have been mostly achieved in 2013(60% increase in cargo traffic volumes during the same period).

(2) More stringent global regulations on SOx

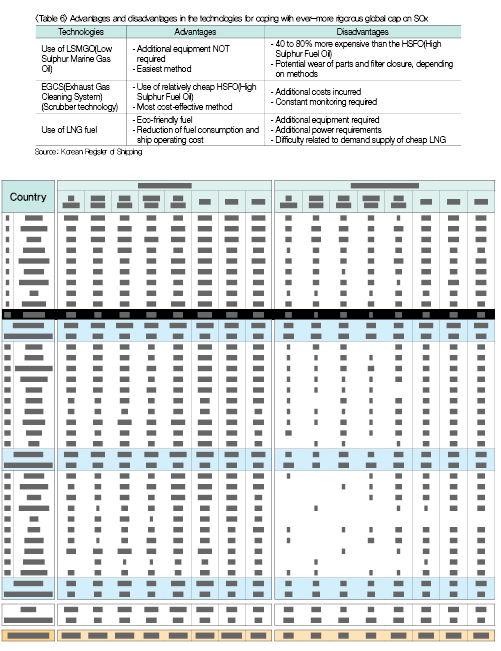

The IMO adopted a resolution at the 70th session of the MEPC(Marine Environment Protection Committee) to lower the sulfur content of marine fuel oil to less than 0.5% from 2020. Therefore, ship owners in Denmark consider it necessary to select the most optimal method for reduction of SOx emissions from ships in order to comply with ever-more stringent global cap on the SOx.

3. Outlook and Implications for Korean Companies

(1) Strategies focusing on marine equipment conducive to compliance with more stringent global cap on SOx

There are 3 major technologies to cope with ever-more stringent global cap on the SOx(see Table 6). Despite the prospect for more robust LNG carrier market, there are limitations as LNG bunkering has yet to be established. Attention needs to be paid to related marine equipment, given that Korean government is mulling over the measure to use the Busan Port and Ulsan Port as bunkering bases.

(2) Scrubber technology coming into the spotlight

According to the Korean Register of Shipping’s Guideline for Ship Owners on the Response to Stringent Global SOx Regulation, the most economically viable method among the aforesaid 3 methods is the use of scrubber technology. Scrubbers are classified into the closed type, open type and hybrid type, and it is important to select the scrubber suited for the operation pattern of ship owners.

According to Peter Grønsedt, a business analyst with Norden, a shipowner in Denmark, a ship outfitted with scrubber system can save approximately USD 2,000 a day, even if it is based on price difference between HSFO(High Sulphur Fuel Oil) and LSMGO(Low Sulphur Marine Gas Oil), a relatively conservative method of estimation, which is very significant cost reduction leading to strong competitiveness. Therefore, Korean companies, which are paying close attention to Danish market for scrubber technology thrust into limelight, will be likely to enter into the market more easily if they focus on development of scrubber.