Special Report Shipbuilding Industry Trends and Outlook for 2019

페이지 정보

작성자 최고관리자 댓글 0건 조회 5,410회 작성일 19-05-29 17:44본문

Ⅰ. Global newbuilding market trend and outlook

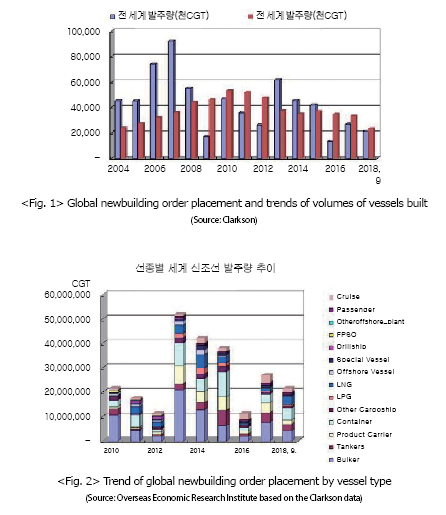

1. Global newbuilding demand has been rebounding smoothly until the third quarter of 2018, but the volumes of vessels built have been shrunk constantly due to thinning order book resulting from previous slump in new order intake

Newbuilding demand has yet to be formed in full scale as shipping companies have not taken concrete measures to cope with ever more stringent regulation on sulfur oxides(SOx) which is slated to come into force by 2020. However, the turnaround in the newbuilding demand has been driven by the need to make investment based on low newbuilding prices, to replace old vessels and scrapped vessels after the stringent regulations takes effect, and to stimulate international LNG market. Global cumulative order placement until September rose 12.9% year-on-year to 21.14 million CGT while the amount of order placement fell 9.3% year-on-year to USD 45.13 billion in the same period. Quantity of vessels ordered has increased in overall sense, but the amount of orders has declined as the high-priced cruise ship volumes are sliding.

As the effect of plunging demand for vessels in 2016 began to be manifested from 2018, global volumes of vessels built decreased by 11.9% year-on-year to 22.3 million CGT due to thinning order books.

2. Remarkable rise in order placement for LNG carriers and containerships by vessel type

LNG carriers have become the most important type of vessel in the newbuilding market in 2018 as global LNG carrier order placement increased 253% year-on-year until September amid expansion of LNG maritime cargo traffic volumes on the back of the increase in global LNG supply and stronger demand. Global new orders for containerships rose 94.8% year-on-year in the midst of an increase in new orders primarily for large-scale containership, resulting in stronger demand with LNG carriers in 2018.

Meanwhile, cruise ship order placement plunged 41% year-on-year, but has maintained at a level twice higher than that recorded before 2013. However, bulk carrier order placement slid 6.2% while tanker(crude carrier) order placement dipped 0.6% year-on-year.

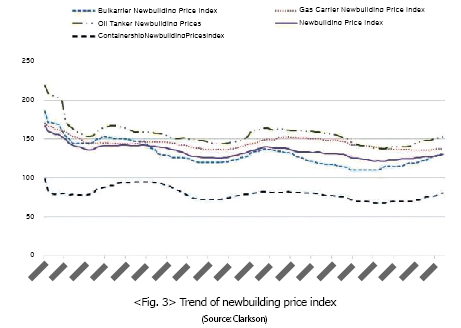

3. Clarkson newbuilding price indices by vessel type edged up about 1-4% in Q3, continuing sluggish growth after Q2 of 2017

Clarkson’s newbuilding price index rose 1.6% to 129.97 points in September during the third quarter and has risen 4.2% in 2018. In last September, newbuilding price index for tankers rose 2.0% to 152.61 points in the third quarter and increased by 7.9% in 2018. The newbuilding price index for containerships hit 80.19 points in the same month, edging up by 4.2% in the third quarter and increasing by 13.9% in 2018. The newbuilding price index for bulk carriers rose 2.1% to 130.28 points in the third quarter and increased by 9.4% in 2018. The newbuilding price index for gas carriers in the same month rose 0.8% to 137.85 points in the third quarter and increased by 1.2% in 2018, the smallest increase among the 4 types of vessels.

4. The share of orders at the 3 Asian countries(Korea, China and Japan) jumped to 87%, re-creating the market structure of the past. Noticeable rise has been observed in global market share of Korean shipyards in 2018.

With decline in cruise ship order placement, cruise ships are accounting for a diminishing proportion of all vessels ordered. As the order intake ratio(based on CGT) of the three Asian countries has recovered to 87.3% until last September, the global shipbuilding market has witnessed a revival of previous structure of market where the three countries swept 83~88% of all vessels ordered worldwide. The year 2018 saw an expansion of LNG carrier market and an increase in order placement for large-scale containership, creating market conditions favorable to Korean shipyards. Meanwhile, the decline in bulk carrier order placement has placed Chinese and Japanese shipyards at a disadvantage.

Based on cumulative order intake, as of last September, Korea has carved out 45.0% share of global market while China and Japan garnered 30.8% and 11.5% share, respectively.

5. Improvement in shipbuilding market is expected to continue, albeit not significantly, in 2019

Global newbuilding order placement is expected to hit 27.50 million CGT and global order placement is expected to reach approximately USD 67 billion in 2018. The new order placement of some large-scale offshore plants is expected to be confirmed by the end of 2018 and was included in the forecast amount of new order placement.

In 2019, LNG carrier order placement may decline slightly in 2019, but the increase in the number of vessels scrapped pursuant to environmental regulations is expected to boost the demand for ship replacement while the high oil prices are likely to push the demand up for high efficiency vessels. The offshore plant market is unlikely to rapidly expand, but is expected to see small quantity of orders placed mainly for production facilities.

Global order placement is expected to rise about 13 % year-on-year to 31 million CGT in 2019, which will mark the first time that 30 million CGT is ever exceeded after 2016. The amount of order placement is expected to rise roughly 22% from the previous year to reach USD 83 billion amid the increase in ship prices and slight expansion of offshore plant market.

6. The funding conditions in ship financing market after 2019 may become a significant variable affecting the newbuilding market conditions

The demand for newbuilding vessels will be bolstered by the increase in number of vessel scrapped and the need to cope with regulations, rather than actual demand for shipping, except for some vessel types such as LNG carriers, for a few years to come. Ship owners are facing the need to invest enormous investments arising from replacement of old and scrapped vessels with newbuilt vessels, as well as the costs difficult to be passed onto forwarders such as the cost incurred from remodeling of ballast water treatment system, scrubber installation, and use of high-priced fuel with low sulfur content, while coping with environmental regulations.

However, ship owners in financial distress caused by prolonged recession have no alternative but to depend on financing. The funding from global ship financing institutions is likely to be a significant variable influencing the global newbuilding demand in the period ahead.

Nonetheless, the newbuilding demand may be shrunk more than expected if the funds are not provided smoothly in the ship financing market, coupled with reduction in the liquidity due to interest rate hike in the United States.

7. The recent call for deferring the implementation of stringent sulfur oxides(SOx) regulations in the United States is expected to affect the market and may slightly slow down the pace of recovery in newbuilding demand.

This issue will be discussed in the IMO(International Maritime Organization) meeting, but the likelihood of postponement of the stringent regulation is considered less likely. However, the possibility of some delay cannot be ruled out. In such a case, the recovery in the newbuilding demand among ship owners coping with the regulations is expected to further slow down. Although the demand will not vanish, short-term demand may fall slightly.

Ⅱ. Trend and outlook of Korean shipbuilding industry

1. Korean shipyards swept new orders for LNG carriers in stronger demand, and as a result, registered relatively larger orders despite unfavorable global market trend.

Across the newbuilding order placement market in 2018, global shipbuilding market has witnessed a surge in the demand for LNG carriers and relatively brisk upward trend in the large-scale containership and oil tanker segments where Korean shipyards have shown relatively stronger performance.

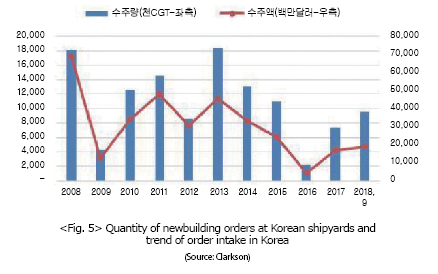

Until last September, global newbuilding order placement rose about 13% year-on-year while quantity of orders at Korean shipyards jumped 70.5% to 9.5 million CGT. The amount of order received in the same period increased by 39.2% year-on-year to USD 18.99 billion.

New orders at Korean shipyards stood at 3.41 million CGT, driven by the demand for LNG carriers/takers and ultra-large containership of Hyundai Merchant Marine, etc., in the first quarter, increasing from 2.38 million CGT in the second quarter.

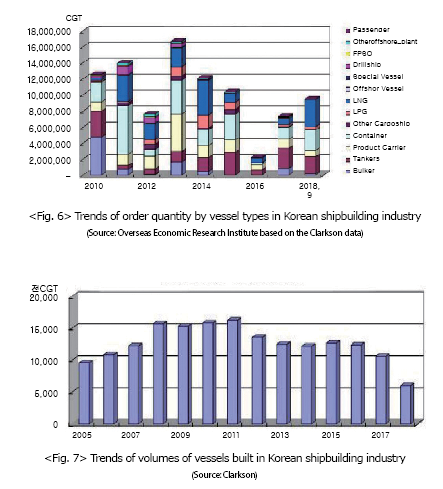

2. By vessel type, the share of LNG carriers increased sharply in all vessels ordered. Containerships and oil tankers have dominated the order books.

LNG carriers comprised 36% of all vessels ordered until last September wile containerships and oil tankers accounted for 27% and 23%, respectively. Those three types of vessels comprised as high as 86% of all vessels ordered in the same period.

The share of LNG carriers in all vessels ordered increased sharply from the previous years, but is considered to be excessively higher for current conditions of global LNG shipping industry although LNG carrier order intake is expected to increase on the back of strong growth of international LNG industry for the time being. Currently, there are 10,000 tankers and 10,000 bulk carriers in global mid and large-sized fleets. By contrast, there are only 540 LNG carriers in the world. New orders for newbuilding LNG carriers have outstripped those for other types of vessels although the LNG carrier fleet is relatively smaller compared to any other fleets. This suggests that newbuilding demand in the market for major vessel types has yet to be recovered in a relative sense and that the demand for LNG carriers has skyrocketed temporarily.

Demand for LNG carriers is buttressing the weak demand for major vessel types while the demand has yet to be created in full scale in connection with the response to stringent environmental regulations. However, such a trend is not expected to be maintained over the long-term.

No order intake for offshore plant was recorded until last September. However, 1 unit of FPU(Floating Production Unit) worth 4.5 billion USD was reported in October and the orders for another 2 units of FPU are expected to be placed, including the large-scale production facility currently in the process of bid.

3. Sharp decline in volumes of vessels built

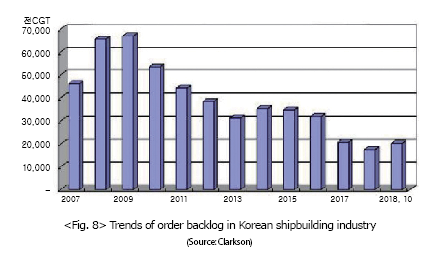

The volumes of vessels built until last September stood at 6.03 million CGT, a 33.8% decrease from the same period of the previous year. Total volumes of vessels built in 2018 are expected to be less than 8 million CGT, which is an all-time low after 2005.

4. Slight increase in order backlog

Order backlog stood at 20.37 million CGT, as of early October, which represented an increase by 17.0% from the beginning of the year. Order intake turned higher than expected in 2018 while the volumes of vessels built remained extremely low, and as a result, the order backlog increased slightly.

5. Korean shipyards are expected to see a slight decline in new order intake and a slight increase in volumes of vessels built in 2019. The decline in new order intake does not signify a delay in improvement.

Quantity of newbuilding orders at Korean shipyards is expected to increase by 48.9% year-on-year to 11 million CGT while the amount of newbuilding orders at Korean shipyards is expected to rise 48.1% year-on-year to USD 25.4 billion in 2018. This includes new orders for offshore plants worth about 3.5 billion which are expected to be received by the end of 2018.

In 2019, quantity of newbuilding orders at Korean shipyards is expected to decrease by about 5% year-on-year to 10.6 million CGT while amount of newbuilding orders at Korean shipyards is expected to rise approximately 4% to USD 26.4 billion. As the demand for LNG carriers is expected to remain strong, LNG carriers are likely to comprise significant proportion of all vessels to be ordered in 2019 albeit lower than in 2018.

Moreover, the demand for major vessels types of Korea, such as tankers or containerships, is not expected to show significant increase until the second half of 2019 and therefore annual order placement is unlikely to increase sharply. However, global newbuilding market conditions are expected to show a slow rebound and Korean shipyards are expected to capture about 35% share of global market without difficulty. Therefore, the decline in order quantity does not signify a setback.

New orders for offshore plants are expected to increase slightly to about USD 5 to 6 billion. As a result, amount of new orders is expected to edge up despite the decrease in order quantity.

Although it would be necessary to use LNG carriers when they are in greater demand, there would be a growing need to strengthen technology and cope with environmental regulations on major vessel types such as tankers, containerships, etc., and at the same time, to make efforts at sales.

Volumes of vessels built are expected to increase from less than 8 million CGT in 2018 to 8.5 million CGT in 2019. However, production still remains sluggish.

- 이전글조선업 동향 및 2019년 전망-국문 19.05.29

- 다음글Cut your total cost of ownership by up to 45% with this new aseptic valve 19.05.29