Feature Story Trends of Shipbuilding Industry in India

페이지 정보

작성자 최고관리자 댓글 0건 조회 3,764회 작성일 19-05-29 12:09본문

1. Overview and status of shipbuilding industry of India

(1) Shipbuilding and offshore industry of India

India is located in the north of the Indian Ocean and geographically protruding toward the Indian Ocean. India has the coastline with a total length of 7,517 km, 12 major ports and 200 small and medium-sized ports. Shipping comprises a large proportion of transportation in India. According to the India’s Ministry of Shipping, shipping accounts for 95% of India’s trade by volume and 70% of the country’s trade by value.

According to the India Brand Equity Foundation, cargo traffic handled at 12 major ports in India between April and August in 2017 stood at 237.69 million tons, up 3.26% from the previous year. Total logistics throughput in all ports across India for the fiscal year 2016/17 amounted to 1.13309 billion tons, an increase by 5.7% compared to the same period of the previous year. To cope with the increase in shipping volume, the government is actively promoting shipbuilding and shipping industries. About USD 1.64 billion were invested as foreign direct investment(FDI) in concerned sectors from April 2000 to March 2017.

(2) Indian government’s policies to promote shipbuilding and offshore industries

Indian government has fully allowed the FDI in port, port construction and maintenance projects. Moreover, Indian government plans to offer a 10-year tax-exemption benefit to companies that develop, maintain and operate ports, inland waterways and inland ports. India’s Ministry of Shipping plans to launch development of 37 national waterways among the 111 nationally designated waterways announced in 2016 under the National Waterways Act 2016, and substituted existing Major Port Trusts Act(1963) with the Major Port Authorities Bill(2016) to strengthen the autonym related to operation of ports and to improve major ports.

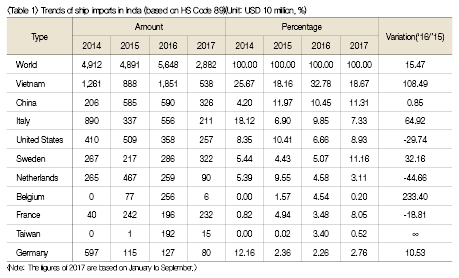

2. Status of imports and major items

According to the GTA, imports of vessels in India(HS Code 89) increased from USD 4.9 billion in 2014 to USD 5.648 billion in 2016. China and Singapore exported vessels worth USD 1.85 billion and USD 590 million, respectively, to India in 2016 with both countries taking the first and second spots. Japan (USD 556 million), Norway (USD 358 million), and Korea (USD 286 million) are trailing behind.

3. Major items and tariff rates in shipbuilding industry

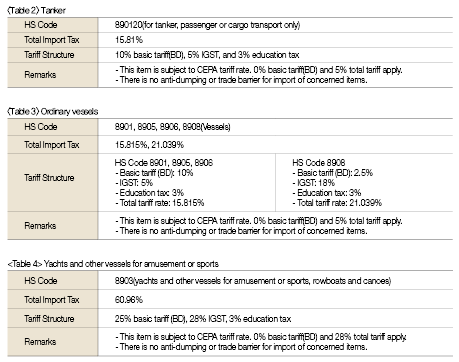

(1) Tanker(HS Code 890120)

Tankers refer to the commercial vessels designed to carry large volumes of liquid or gas. Among the major tankers are included crude oil carriers, chemical tankers, and gas carriers used to carry the crude oil and chemical products through waterways to other locations. According to the GTA, Korea exported concerned products worth USD 166 million to India from January to September 2017.

(2) Ordinary vessels

Ordinary vessels are multi-type vessels that serve various functions, including the HS Code 8901(cruise boats, cruise ships, ferry boats, cargo ships, barges and similar vessels), HS Code 8905(lighting vessels, fire-fighting vessels, dredgers, other special vessels with special functions other than sailing), HS Code 8906(other types of vessels), HS Code 8908(ships and other floating structures), etc. There are few companies in China, Japan, Korea and Singapore that export concerned items to India.

(3) Yachts and other vessels for amusement or sports(HS Code 8903)

This category consists of yachts and other vessels for amusement or sports, rowboats and canoes and classified into ordinary yachts and motorboats. The HS Code 8903 applies to the yachts. Few yachts are imported in India because many Indian companies are producing same products domestically. India’s total imports of yachts stood at no more than USD 2 million, as of 2016.

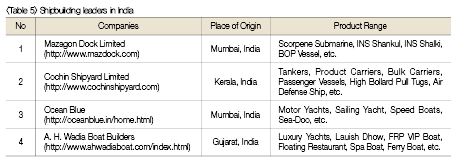

4. Shipbuilding leaders in India

Among the leaders in shipbuilding industry of India are included Mazagon Dock Limited, Cochin Shipyard Limited, Ocean Blue, A. H. Wadia Boat Builders, etc.

5. Implications

(1) India’s shipbuilding industry transforming into a promising market of the future

Shipbuilding industry imports for cargo and passenger maritime transport have been on the rise each year. During the first 9 months of 2017, Korea’s exports to India totaled USD 322 million, up from USD 182 million recorded in the previous year. As a result, Korea has become one of the countries with the largest exports to India. India’s share of the world economy still remains low. The demand for shipbuilding is likely to increase, particularly in the coastal area, due to poor inland transportation conditions.

(2) Price competitiveness bolstered by Korea-India CEPA & proactive attitude of Indian government

Only 5% GST is applied to tanker(crude oil carrier) imports and only inspection of export products by relevant authorities has been requested while Korean companies with business rights in Indian market are expanding their boundaries. As the export products have only to meet international standards, no additional certification of products is required for cargo and passenger transportation. Shipbuilding industry is promising for Korean companies, given that the India’s Ministry of Commerce, Industry and Energy and customs authorities are not currently taking anti-dumping, safeguard and countervailing measures in response to the rising demand for products.

It is considered a good opportunity for companies to maintain their foothold as the Indian government is actively attracting foreign investment in this field at policy level. However, as most transactions are settled by credit, the ship industry, a growing industry in India, has seen low involvement of companies in exports and imports. Therefore, it would be necessary to build trust with Indian companies and secure stable funds for Korean companies to maintain their position in concerned market.