Feature Story Strong outlook for the tanker market in 2024 and beyond

페이지 정보

작성자 최고관리자 댓글 0건 조회 1,010회 작성일 24-04-16 11:44본문

Several factors have aligned over the past two years to create a robust and profitable market for tanker owners, which is expected to drive newbuild activity over the coming years.

"Like everything else, supply and demand forces dictate the market,” says Catrine Vestereng, SVP and Global Business Director for Tankers at DNV. “However, in the case of the tanker market, this is twofold: the supply and demand of vessels and the supply and demand of oil and oil products.”

Geopolitical trends support market activity

More than any other segment in the maritime industry, the tanker market is significantly influenced by global geopolitical and economic trends. The strength of today’s market can be traced back to the start of the Ukraine conflict in 2022.

“Before the conflict, a large part of the global oil and oil product trade came out of Russia,” explains Vestereng. “However, Western sanctions have led to a realignment of many of these trading channels. Many of the biggest buyers have had to source their oil and oil products from different locations, and this could become a permanent feature. It has led to more sea trade, longer routes, the need for more tankers, and higher freight rates for tankers.”

OPEC cuts extended into 2024

These trends were accentuated by a return to normal global oil demand after the Covid-19 pandemic and OPEC cuts to global oil supply.

Additionally, an expansion in refinery capacity in recent years has led to a surge in crude oil demand in China and, to a lesser extent, India. At the same time, domestic demand in the US has stagnated, opening the door for a rapid acceleration in exports.

“Demand is back to normal, but OPEC has reduced output in order to boost oil prices, and recently announced that this would be extended into 2024,” says Vestereng. “Much of the supply shortfall created by these cuts has been replaced by US shale producers who can ramp up production quickly when needed. This also means that oil is being traded over longer distances, which is further boosting freight rates.”

Windfall drives reinvestment in newbuilds

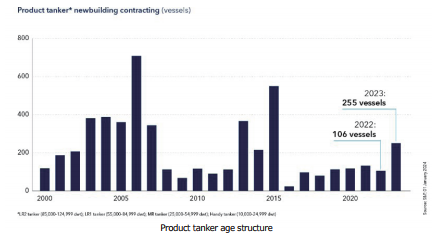

The windfall created by these trends has driven many tanker owners to reinvest.

“Most tanker owners want to take advantage of this positive market environment,” says Vestereng. “However, they realize that they need more vessels to do so, and this is driving a big cycle of investment in newbuilds.”

An acceleration in exports from the US to Asia means that larger crude oil tankers, such as VLCC 200,000+ dwt, are expected to be particularly favoured in this newbuild activity.

Cargo owners demanding younger, more efficient vessels

An ageing global fleet is also driving the need for tanker newbuilds. 29% of the VLCC 200,000+ dwt fleet is over 15 years of age, with this number increasing to 32% for the Suezmax 125–199,000 dwt fleet and 50% for the Aframax 85–124,999 dwt fleet. Similar numbers apply to most of the other subsegments, including product tankers. This is an issue for tanker owners, as stricter ESG requirements mean that cargo owners are demanding younger, more efficient vessels.

“The fleet is getting extremely old, which is a growing issue as environmental regulations get stricter,” explains Vestereng. “Most of the oil majors are putting an age limit on the vessels that they will use, usually around 15 to 20 years. Safety is part of this, but environmental considerations are more important. Older vessels are much less efficient than newer ones. They have higher fuel consumption, which means more emissions and higher costs, especially in the new regulatory environment.”

Tankers behind rest of market for decarbonization in 2023

Like the rest of the maritime industry, increased regulation and stakeholder demands mean that decarbonization is never far from the minds of tanker owners. This is difficult for the existing fleet, which mainly have to utilize operational energy efficiency measures to reduce emissions. While the options are wider for newbuilds, this was generally not utilized in 2023 due to the high competition for yard space.

“Because the market was tilted towards the shipyards last year, they were often able to dictate terms to the tanker owners. With shipyards wanting to complete projects as quickly as possible, this generally led to tanker newbuilds which were not high spec, particularly when it comes to decarbonization,” says Vestereng.

Dual-fuel readiness main decarbonization measure on newbuilds in 2023

With decarbonization measures not prioritized in 2023, many yards and owners have attempted to future-proof against increasing regulatory pressure by making tankers “dual-fuel ready”.

“This was done for the majority of vessels ordered in 2023 and basically means that space is left in vessels for the installation of dual-fuel engines at a later stage,” says Vestereng. “This can be for any kind of fuel, so has the advantage of creating flexibility for future operations.”

While there is more room for further investment in decarbonization measures for tanker newbuilds, tanker owners fear that they will not receive a return on this investment from short-term charter contracts only. To increase their willingness to invest in new fuels and technologies it is, therefore, crucial that cargo owners guarantee longer contracts.

Improved picture for 2024

Conditions for decarbonizing tankers are expected to improve in 2024.

“The appetite at shipyards for bringing in tankers has increased, particularly as there are less orders for containerships and Chinese yard capacity is expanding,” says Vestereng. “This should lead to more flexibility and higher quality when it comes to decarbonization.”

What will a typical newbuild tanker look like in 2024?

“Some smaller subsegments, such as chemical tankers and some smaller product tankers, were successful in 2023 in applying energy efficiency measures, such as waste heat recovery, shaft generators and wind-assisted propulsion, and we are expecting to see even more of this in 2024,” continues Vestereng. This should also extend to alternative fuels.

“Newbuilds with dual-fuel engines accounted for 12% of tankers in 2023 compared to 18% for the rest of shipping. We are expecting a higher percentage in 2024, including for the larger crude tankers.”

Cyber security also on the agenda for tankers

Like the rest of the maritime industry, cyber security is an increasingly important consideration for tankers. “New IACS regulations will be implemented from July which mean that all newbuilds need to be fully protected from cyber threats,” says Vestereng. “We already see that many of the tankers ordered now include cyber as a notation.”

Some subsegments are more technically specified than others, heightening the need for cyber protection. “For example, shuttle tankers, which offload oil from FPSOs, are highly sophisticated and digitalized because of their advanced operational conditions on dynamic positioning. So I consider cyber security to be particularly important for these kinds of vessels,” explains Vestereng.

Tanker market set to remain strong in years ahead

Continued fundamentals means that there is no end in sight for the strengthening tanker market.

“Supply issues are expected to become more accentuated in the years ahead, especially as newbuilds struggle to keep up with a steadily ageing and less efficient fleet,” concludes Vestereng. “As long as freight rates stay at a high level, the appetite for newbuilds will continue.”

■ Source: DNV www.dnv.com

- 이전글Winds of Change: Harnessing Rotor Sails for Vessel Efficiency 24.04.16

- 다음글선박 대체연료 기술 개발 동향 조사② 24.04.16