Feature Story Emissions data tracking key to EU ETS and CII cost management

페이지 정보

작성자 최고관리자 댓글 0건 조회 1,325회 작성일 23-09-15 12:23본문

Requirements to reduce emissions will have a significant impact beyond regulatory compliance as they will also affect economic factors such as operating costs, balance sheet risk, commercial attractiveness, earnings capacity, access to capital and asset values, as well as financial control.

High cost of carbon credits

According to DNV’s Director Environment Maritime Eirik Nyhus, the EU ETS will lead to additional costs for the industry of roughly up to €10 billion a year once fully implemented in 2026, due to the need to acquire carbon credits corresponding to GHG emissions. This will effectively increase fuel-related costs by about 50%.

EU ETS sets stricter requirements over time

The expansion of EU ETS to shipping, due to introduced initially for cargo and passenger ships above 5,000gt over a three-year period from 1 January 2024, will require shipping companies to buy EU Allowances(EUAs) to cover their annual emissions with each EUA equivalent to 1 tonne of CO2. Companies will initially be liable for 40% of their CO2 emissions in 2024, rising to 70% in 2025 and 100% in 2026. This EU ETS revision became law in June. All emissions on voyages and port calls within the EU/EEA, and 50% of emissions on voyages into or out of the EU/EEA, will be subject to the EU ETS once fully implemented.

Annual emissions reported under the EU’s MRV(Monitoring, Reporting and Verification) regime will form the basis of a verified company emissions report that will determine the volume of allowances to be purchased and surrendered to the authorities by 30 September each year following the reporting year with heavy penalties for non-compliance.

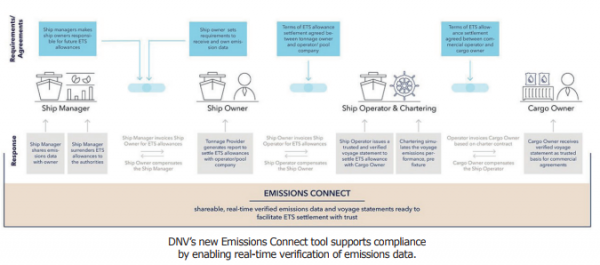

Multiple commercial transactions under EU ETS required

Nyhus explains that in addition to the legal compliance aspect, the EU ETS will also have an immediate financial impact on shipping companies as they will start building up liabilities for emissions from 2024. Purchasing EUAs can be a significant expense for shipping companies which is likely to have implications for pricing and other terms of contractual agreements among different stakeholders, including charterers and cargo owners, he adds.

The EU ETS will trigger multiple commercial transactions among stakeholders to cover EUA costs in relation to voyage charters and these will need to be settled on an ongoing basis using accurate data to meet financial obligations to buy the right number of EUAs. Emissions must also be quantified for environmental reporting to the authorities, as well as other stakeholders such as banks, charterers and investors, to measure progress on decarbonization.

Emissions data verification solution

DNV has therefore launched the real-time data verification solution Emissions Connect™, a collaborative data-sharing tool accessible to all stakeholders – ship manager, owner, operator, charterer and cargo owner – on the Veracity platform to support such transactions. This provides a single source of truth for trusted, reliable and verified emissions data available in real time for all contractual parties for operational control and accurate accounting of emissions at every part of the value chain to facilitate financial settlements under the EU ETS.

Emissions Connect™ provides valuable services beyond verified emissions data

In addition, Emissions Connect™ can generate a verified voyage statement based on common standardized datasets to give an accurate record of emissions performance that can be shared with third parties in relation to regulatory compliance, as well as the Poseidon Principles and Sea Cargo Charter. It is also possible to simulate and benchmark the emissions performance of different voyage planning scenarios.

DNV’s Principal Consultant in Shipping Advisory, Knut Ljungberg, says Emissions Connect™ will help companies to manage increased administrative complexity with budgeting and reporting in relation to EUAs. “Shipping companies will need to establish procedures to purchase EUAs and budget for the estimated cost of allowances, as well as determine contractual liabilities across the value chain, to manage and minimize their financial risk,” he says.

Shipping companies will need systems in place to manage

costs and compliance in future as they face higher financial

exposure from the EU’s Emissions Trading System(EU ETS),

as well as new regulations such as CII. With trusted,

verified emissions data and a dynamic decarbonization plan

DNV supports the industry to manage financial risks.

CII requirements aim to drive decarbonization

Shipping companies also face new IMO reporting requirements starting this year for the Carbon Intensity Indicator(CII) that applies a rating of A–E for vessels above 5,000gt based on grams of CO2 emitted per cargo carrying capacity and nautical mile. Every vessel must have an operational plan to improve its CII rating in the mandatory Ship Energy Efficiency Management Plan(SEEMP) Part III and low-rated vessels that fail to comply could risk sanction, including trading bans.

The CII rating of a ship is set to become an increasingly important factor in charter terms, essentially determining its competitiveness and ability to trade over the longer term. This imposes a balance sheet risk that can have an impact on shareholder value, access to capital and commercial attractiveness.

Stay competitive with DNV's ship specific Decarbonization Plan solution

Both CII and EU ETS cost calculations are now included among benchmarking criteria used in DNV’s Decarbonization Plan, a ship-specific solution optimized for compliance to relevant targets with minimal costs for the expected lifetime of the vessel. This is intended to ensure the vessel remains competitive in the market and prevent it from becoming a stranded asset. The plan for each vessel is compiled into a fleet overview and can be used to generate the required SEEMP-III documents.

The dynamic plan, which is updated in line with regulatory changes, can determine the compliance status of a vessel against applicable frameworks – including IMO regulations, Poseidon Principles and Sea Cargo Charter – and also takes into account factors such as trading patterns, docking schedule, vessel speed, CO2 tax and fuel prices. DNV experts working together with the shipping company can then evaluate a range of operational and technical measures, such as propulsion improvements or alternative fuels, and assess the cost-benefit of these to find the optimal decarbonization strategy.

In the case of the EU ETS, simulations can be carried out to predict costs based on trade routes, fuel price, carbon price changes and different CO2 tax levels, Ljungberg explains.

“Higher fuel-related costs due to the EU ETS will improve the business case for emissions-reduction measures due to a shorter payback time. Stricter regulations and rising costs for emissions will therefore accelerate the transition to low-carbon shipping,” he says.

■ Source: DNV www.dnv.com