Special Report Trends of Shipbuilding Industry & Outlook for 2019

페이지 정보

작성자 최고관리자 댓글 0건 조회 2,404회 작성일 19-05-29 15:00본문

Ⅰ. Industrial Environment

1. Outlook for economy and international trade growth

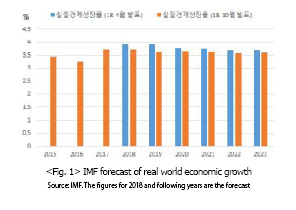

(1) World economic growth is expected to reach 3.65% in 2019, sliding 0.08%p from the previous year(the IMF forecast in October 2018).

In 2019, global economic growth will be disrupted by negative factors such as instability in the emerging economies, trade dispute between the United States and China, etc. Compared to the forecast in April 2018, the real economic growth forecast has been adjusted downward. The forecast for real economic growth of 2018 was adjusted downward by 0.21%p from 3.94% to 3.73%. Meanwhile, the forecast for 2019 was adjusted downward by approximately 0.29%p from 3.94% to 3.65%. The forecast for the next 4 years was adjusted downward by about 0.1%p, compared to the April forecast.

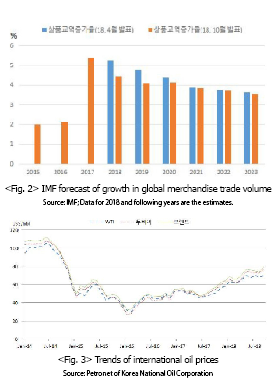

(2) The growth rate of merchandise trade volume in 2019 is expected to slow down, compared to the previous year, and was adjusted downward significantly in April last year which suggests that the trade conditions have turned unfavorable.

According to the data published by the IMF in October last year, the global merchandise trade volume is expected to increase by 4.13%, which represents a 0.32%p decrease from the previous year, and is predicted to decline slowly to 3.55% until 2023. The figure has been adjusted downward significantly from the forecast published in April 2018. The merchandise trade volume in 2018 was expected to grow by 5.27% in April, but the figure was adjusted downward by 0.82%p to 4.45%in October. The growth rate forecast for 2019 was adjusted downward by 0.66%p from 4.79% to 4.13%.

And protectionism triggered by trade disputes between the United States and China is causing disruption to overall global trade environment and likely to have a negative impact on the recovery of shipping market conditions.

2. Oil price and trends of steel material prices

(1) International oil prices on an upward trend in Q3

Average Brent oil prices hit USD 79.1 a barrel in September, increasing by 4.2% from the end of the previous quarter. Prices of Dubai crude rose 4.9% to USD 77.2 a barrel in the same period. WTI prices climbed 4.1% to USD 70.1 in the same period. With the increased production of shale oil in the United States, the prices of oil in the United States remained lower than those of other fuel types. Oil prices increased in the third quarter due to the impact of sanctions on Iran and are expected to hover above USD 70 in 2019.

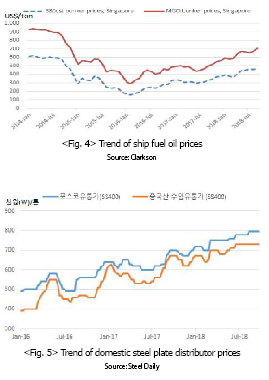

(2) Ship fuel oil prices climbed to an all-time light since 2015

The average bunker oil price based on Singapore ex-wharf 380 CST bunker term contract reached USD 471 per ton in September, a 5.1% increase from the end of the previous quarter, and exceeded USD 500 on average in October last year. The average price of MGO for the same month reached USD 706 per ton in September, an increase by 6.3% from the end of the previous quarter.

(3) Steel plate prices remained relatively stable in Q3

During the third quarter, POSCO’s distributor price(SS400) reached KRW 795,000 per ton, an increase by 1.9% from the end of the previous quarter which is attributed to the KRW 15,000 hike in August. The increase slowed down, compared to the 4% increase during the previous two consecutive quarters. Steel plate prices are expected to stabilize although the price hikes have not stopped.

The Chinese import distributor price(SS400) was maintained at KRW 730,000 per ton from the previous year until the third quarter.

Ⅱ. Trends and outlook for shipping industry

1. Bulker market

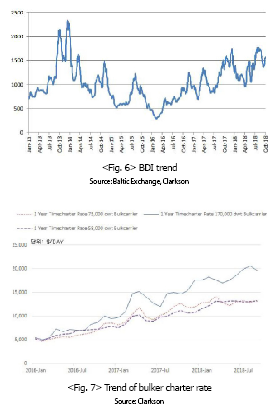

(1) A turnaround in BDI during Q3

The BDI, which remained more sluggish than expected due to slowdown in imports of iron ore from China during the first half of the year, hit an average of 1,067 in the third quarter, up 41.3% year-on-year. The growth in shipping demand has slowed considerably in the aftermath of trade disputes, reorganization and restructuring of steel industry in China, contrary to the earlier expectation for relatively strong rebound on the back of robust growth in trade volume. In 2018, growth in shipping volume was expected to reach about 4%, but is likely to stand actually at less than 3%.

It is considered that the number of vessels supplied newly has not kept pace with the growth of demand after 2015, given that capacity of vessels ordered newly remains low. In 2018, market conditions have improved slowly.

(2) Bulker charter rate in Q3 was on an upward trend, but adjusted slightly in some ship types

The charter rate for 170Kdwt Capesize bulker based on 1-year regular charter rate fell 4.5% from the previous month to USD 19,638 per day in September. However, average charter rate in the third quarter reached USD 20,090 per day, 12.8% higher than that of the previous quarter. Average charter rate for 75Kdwt Panamax bulker stood at USD 13,162 per day in third quarter, up 3.2% from the previous quarter. Average charter rate for 58Kdw Handymax bulker reached USD 13,115 per day in third quarter, a 0.6% decrease from the previous quarter. The charter rate for 58Kdwt class bulker continued to rise from August, but fell slightly in July. As the increase was slow, average charter rate declined from the previous quarter.

(3) In 2019, a slow recovery in bulker shipping market conditions is expected amid global economic downturn.

The slowdown in the growth of trade volume due to protectionism of the United States and China is likely to make any drastic growth in demand unlikely in the shipping market. However, overseas high-quality iron ore imports may increase amid restructuring of Chinese steel industry. In light of that, overall demand for bulker shipping demand is expected to grow by about 3-4%. As new the capacity of vessels ordered from 2015 to 2017 is limited, a slow turnaround in market conditions is expected in 2019 with capacity increased by less than 3%. The BDI in 2019 is expected to be about 10% higher on average than the level recorded in the previous year.

2. Tanker market

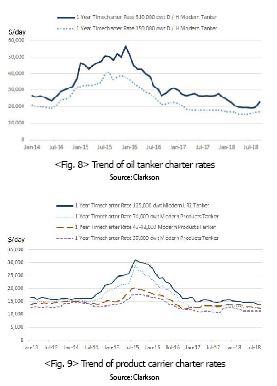

(1) Oil tanker market rebounding slightly in Q3 after persistent sluggishness until Q2

The oil tanker market was expected to show a turnaround in the first half of the year on the back of demand created amid economic recovery in developed countries and massive quantities of vessels being scrapped in the same period. However, growth of demand for shipping fell fallen short of expectations as the OPEC’s oil production cut is maintained. Rather, the market conditions have deteriorated as the tankers ordered during the period of low oil prices were delivered in the first half of the year. Despite slowdown in shipping demand, the oil market conditions improved in the third quarter in the mist of decline in the capacity of tankers delivered after the second half of the year and scrapping of large quantity of vessels in the first half of the year. The 1-year regular charter rate for 310Kdwt VLCC(Very Large Crude Carrier) reached USD 20,308 per day in the third quarter, increasing by 4.8% from the previous quarter, which represents the first significant rebound since 2016. The 1-year regular charter rate for 150Kdwt Suezmax oil tanker reached USD 16,538 per day in the third quarter, increasing by 6.4% from the previous quarter, which is the first rebound since 2016.

(2) No turnaround in product carrier market in Q3, unlike the oil tanker market

Product carrier market is expected to see an increase in capacity by less than 3% in 2018 as a considerable portion of vessels, ordered in large quantity in 2015 during the sustained decline in oil prices, were delivered until 2017. The growth in the demand for shipping was expected to surpass the increase in capacity, considering that the demand for oil products was likely to increase on the back of economic recovery in developed countries. However, the demand growth has fallen short of expectations due to constant increase in oil prices since the beginning of the year. No turnaround in market conditions was observed in the third quarter contrary to the expectation that a rebound in the charter rate would result from the decrease in the number of vessels delivered in the second half of the year. The 1-year regular charter rate for 115Kdwt LR2 tanker reached USD 14,058 per day in the third quarter, sliding 3.9% from the previous. The 1-year regular charter rate for 74Kdwt LR1 tanker reached USD 12,635 per day in the same period, dipping 1.1% from the previous. The 1-year regular charter rate for 47~48Kdwt MR tanker stood at USD 12,587 per day, a decrease by 3.9% from the previous, while the 1-year regular charter rate for 37Kdwt MR tanker stood at USD 11,250 per day, maintaining the level same as that of the previous quarter.

(3) In 2019, any turnaround in tanker market is expected to depend on the trend of oil market, which is difficult to predict.

Among the oil tankers ordered in large quantity in 2017, some are expected to be delivered in 2019 which makes the capacity likely to increase by 3-4% a year. The order backlog of product carriers is expected to increase by about 3% in terms of capacity in 2019, although the problem is less severe than that of oil tankers.

The key to a recovery in tanker market is whether the increase in shipping demand will exceed the capacity growth. The demand for shipping is unlikely to keep pace with the increase in capacity, considering that oil price is expected to reach USD 70 per barrel in 2019 and that economic growth is likely to slow down in comparison to that of the previous year. There still is a room for a turnaround in tanker market if the cooperation among OPEC member countries is weakened and the OPEC oil output increases beyond its target as a result. In addition, the demand for oil tanker shipping will be able to grow by more than 4%, provided that the export capacity is increased through expansion of pipelines in the United States and that the export is actively promoted to stabilize international oil prices for political purposes. If the supply increases and the demand for petroleum products increases beyond expectations due to effect of oil price lower than expected, then the demand for product carrier shipping may hover above 3%. If the supply is increased in oil market, a turnaround in tanker market is expected to be likely.

3. Containership market

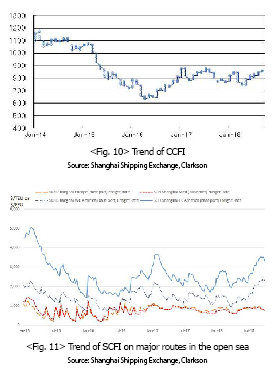

(1) The containership freight rates increased in Q3, but no turnaround occurred as compared to the same period of the previous year

By the third quarter of 2018, the CCFI index averaged 810, down 2.9% year-on-year. The CCFI continued to climb in the third quarter, hitting 836 on average which was, however, 1.2% lower year-on-year. The market was considered to have been strained by delivery of many vessels in the first half of the year among those ordered in large quantity in 2015

(2) Increase in freight rates mainly for the U.S. routes in the open sea during the Q3

The average freight rate(based on Shanghai Containerized Freight Index(SCFI)) for Shanghai-Europe route reached USD 881.69 per TEU in the third quarter, up 0.4% from the same period of the previous year. The average freight rate for Shanghai- Mediterranean route increased 7.7% year-on-year to USD 873.31 per TEU. In the same period, the average freight rate for Shanghai-West Coast of the United States rose 37.4% year-on-year to USD 2,507.0 per TEU while the average freight rate for Shanghai-East Coast of the United States increased by 33.8% year-on-year to USD 3,154.77 per TEU on the back of robust U.S. economy.

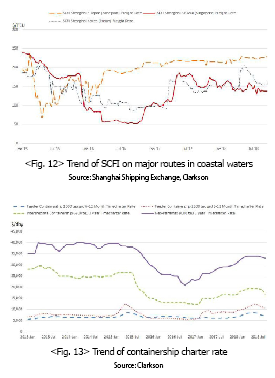

(3) Of major offshore routes, Southeast Asian routes in coastal waters remain sluggish during the Q3

The average freight rates(based on SCFI) for Shanghai-East Japan route rose 3.7% year-on-year to USD 225.85 per TEU, while the average freight rates for Shanghai-Busan route rose 13.6% year-on-year to USD 158.92 per TEU, which represents an increase by a small margin but shows a positive trend despite recently high fluctuations.

The average freight rates for Shanghai-Southeast Asian routes, which witnessed fierce competition, continued to decline until recently, and decreased by 13.3% year-on-year to USD 139.31 per TEU in the third quarter.

(4) Downward trend of charter rate for containership in Q3 The 3-year regular charter rate for the 9,000TEU containership slid 1.5% quarter-on-quarter to USD 33,500 per day in the third quarter, while the 3-year regular charter rate for the 6,800TEU containership fell 4.3% quarter-on-quarter to USD 18,417 per day in the same period.

The 6 to 12-month regular charter rate for 2,500TEU feeder vessel decreased by 3.9% quarter-on-quarter to USD 11,233 per day while the 6 to 12-month regular charter rate for 1,000TEU feeder vessel slid 10.2% quarter-on-quarter to USD 7,600 per day in the same period. The containership charter rate, which was on a steady rise since 2017 despite the delay in the turnaround in freight rates, showed a pattern of adjustment in the third quarter.

(5) Containership market is expected to show a turnaround in 2019

Ultra-large containerships have been delivered constantly, placing a significant strain on the market for open sea routes, including the European routes. This segment has seen an increasingly fierce competition as the medium-sized vessels crowded out are moving to the routes in coastal waters. Since 2016, new orders have decreased significantly compared to the previous yea. As the vessels, ordered in large quantity until 2015, have been delivered completely, the capacity growth in 2019 is expected to be less than 3%.

Although the growth of shipping demand is expected to slow down due to global economic slowdown and protectionism, the demand is expected to be greater than the capacity growth rate of less than 3%. Competition strategies among allies and confusion caused by the cascading effects are still expected to be the variables. However, if the global economy does not shrink sharply, a slight turnaround in the market can be expected in 2019.

4. LNG carrier market

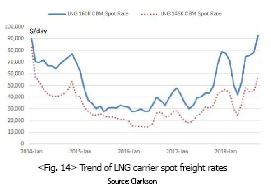

(1) Charter rates and freight rates for LNG carriers climbed very rapidly in Q3

The average spot freight rates for 160KCum LNG carriers climbed 24.0% to USD 92,500 per day on average in September in the third quarter, and the average value in the third quarter was 93.8% higher than the level recorded in the same period of the previous year, increasing very fast in the three-month period. In October, the rate sometimes soared to USD 150,000 per day.

The charter rates for 145 KCum LNG carriers stood at USD 57,250 per day in September, increasing by 18.8% in the third quarter, and the quarterly average was up 66.4% from the same period of the previous year. The charter rate and freight rate for the spring season, where the heating demand dissipated, fell below the break-even point, while the charter rate for long-term period of more than 5 years has been in the range of USD 70,000 per day.

Considering those factors, the charter rate in the chartering market soared as a result of competition among shipping companies for short-term chartering in anticipation of winter heating demand in the third quarter, particularly, the special demand from China, which also led to sharp increase in spot freight rates.

(2) In 2019, freight rates in LNG carrier shipping market are expected to slide slightly from the level of the previous year, but will remain higher than that of other years.

The short-term charter rates and spot freight rates surged in September and October in 2018 as ship owners who saw the skyrocketing demand in China last winter had excessive expectations for the demand growth in winter. As the vessels ordered in the past are steadily being delivered in this market, the capacity was expected to grow in double digits in 2018.

In addition, China is seeking long-term contract to secure certain volumes of LNG under the long-term policy of the Chinese government, rather than purchasing large volumes of LNG at once from spot market. Considering those factors, shipping companies that secured vessels at short-term high charter rates in the winter market may see their profitability lower than expected. As a result, the freight rates and charter rates are likely to be adjusted downward in 2019.

However, the market is unlikely to shrink abruptly, given that the production from LNG supplying countries is increasing steadily with the rising demand mainly from Asia. Overall upward trend of shipping freight rates is expected to be maintained.